Terms & conditions

- Acceptance of Terms & Conditions

1.1 This Platform is operated by Shouta Pty Ltd and its related entities or body corporates (“us”, “we” and “our”). Our Platform is located on the app stores and on the web via the domain https://www.shouta.co/ and http://www.shouta.co/send and http://www.biz.shouta.co

1.2 Your use of this Platform is subject to these terms of use (“Terms & Conditions”). The Terms & Conditions constitute a binding legal agreement between you and us, and your continued use of the Platform constitutes your acceptance and acknowledgement of these Terms & Conditions, our Privacy Policy , and any other policy displayed on the Platform, all of which constitute a part of the Terms & Conditions. If you do not agree to the Terms & Conditions, you must not use the Platform.

1.3 Any time you visit the Platform or use any of the features on the Platform, you are taken to accept these Terms & Conditions.

1.4 We may amend or modify the Platform, the Terms & Conditions and/or the Privacy Policy at our sole discretion and at any time. Any amendments are effective immediately after publication on the Platform. Your continued use of the Platform indicates your continued acceptance of the Terms & Conditions as modified.

1.5 These Terms & Conditions will prevail over any other terms or agreement between you and us.

- Definitions and Interpretation

Definitions

2.1 In these Terms & Conditions:

Account means the account of the Shoutee, which is a prepaid Mastercard debit card topped up by the Shouts.

App means the application, being one of the various Platform’s used to send Shouts to a Shoutee.

Claimed means a shout is considered claimed when a shoutee is registered on the app and the shout is added to their account.

Copyright Act means the Copyright Act 1968 (Cth) as amended from time to time.

GST has the meaning given to it in the A New Tax System (Goods and Services Tax) Act 1999 (Cth)

Maximum Value means the maximum value per Shout by a User on the Platform cannot exceed $250.00.

Minimum Value means the minimum value per Shout by a User on the Platform is $5.00.

Payment Provider means Merchant Warrior.

Platform means the websites located at https://www.shouta.co/, http://www.biz.shouta.co, and http://www.shouta.co/send , App and any service offered under the name “Shouta” and/or “Shouta Biz” and/or “WebShouts”

Platform Fee means a fee of 7% of the total value of each Shout (or as modified from time to time by notification on the Platform or as set out in clause 11.3).

Privacy Policy means our privacy policy available here.

Shout means a gift of money made by a Shouter to a Shoutee.

Shouta Biz Shout means a Shout to one or more persons by either uploading a CSV file and/or manually inserting each Shoutee with the Shoutee’s name, mobile number and email address and sent through Shouta Biz.

Shoutee means a person who is sent a Shout by a Shouter.

Shouter means a person who uses the Platform to send a Shout to a Shoutee.

Shouta Biz means the website version of the Platform where a Shout is sent from http://www.biz.shouta.co.

Shouta Biz Account means the account created on behalf of a company in order to use Shouta Biz.

Subscription Plans has the meaning giving to it in clause 8.1.

Terms & Conditions means these Terms & Conditions which include the Privacy Policy.

Total Transaction Value means a total transaction value not exceeding $3,000.00 when using Shouta Biz, with the Minimum Value and Maximum Value applying per Shout. The Total Transaction Value is only applicable to Shouts sent for Shouta Biz.

Uploaded Content means any content whatsoever which you upload to the Platform, including but

not limited to any descriptions, reviews, usage data, feedback, comments, chats, media.

User means any person visiting or using on the Platform whatsoever, regardless of whether

registered or unregistered.

Warranties mean any warranties, conditions, terms, representations, statements and promises of whatever nature, whether express or implied.

We, we, us, our means Shouta Pty Ltd and its related entities or body corporates.

You or you mean any person, corporation or other body corporate, partnership, trust or association and any governmental agency and that person's personal representatives, successors, permitted assigns, substitutes, executors and administrators who uses or accesses the Platform, including any User.

Interpretation

2.2 In these Terms & Conditions, the following rules of interpretation apply unless the context requires otherwise:

-

- headings are for reference purposes only and in no way define, limit or describe the scope or extent of any provision in these Terms & Conditions;

- where any word or phrase is defined, any other part of speech or other grammatical form of that word or phrase has a cognate meaning;

- a reference to a document (including these Terms & Conditions) is a reference to that document (including any schedules and annexures) as amended, consolidated, supplemented, novated or replaced;

- an expression importing a natural person includes any individual, corporation or other body corporate, partnership, trust or association and any governmental agency and that person's personal representatives, successors, permitted assigns, substitutes, executors and administrators;

- a reference to writing includes any communication sent by post, facsimile or email;

- a reference to time refers to time in Sydney, New South Wales and time is of the essence;

- all monetary amounts are in Australian currency;

- the word “month” means calendar month and the word “year” means 12 calendar months;

- the meaning of general words is not limited by specific examples introduced by “include”, “includes”, "including", "for example", "in particular", “such as” or similar expressions;

- a reference to a “party” is a reference to a party to these Terms & Conditions, and a reference to a “third party” is a reference to a person that is not a party to these Terms & Conditions;

- a reference to any thing is a reference to the whole and each part of it;

- a reference to a group of persons is a reference to all of them collectively and to each of them individually;

- words in the singular include the plural and vice versa; and

- a reference to one gender includes a reference to the other genders.

- Preconditions to use

3.1 Access to and use of this Platform is subject to you being at least 18 years old and having the legal capacity to entering into binding contracts. Accordingly, should Shouta suffer any damage or other losses as a result of a transaction entered into by a minor, we reserve the right to seek compensation for such losses from the minor’s parents or guardians. We may, in our sole discretion, refuse to offer our services including the sale of a Shout via our Platform to any person or entity and we may change our eligibility criteria at any time. By using the Platform you warrant the above to us. If the above conditions are not satisfied, please cease using the Platform immediately.

3.2 The Platform’s mobile app only operates on iOS 11 and higher and Android 23 and higher. Shouta Biz and the Send Website are operative on the most current versions of popular web browsers. If for any reason you are unable to access Shouta Biz or the Send Website Shout from the website’s, we recommend updating your browser.

- Registration

4.1 You will be required to be a registered member to access certain features of the Platform.

4.2 When you register and activate your account, you will provide us with personal information such as your name and email address and other personal details. You must ensure that this information is accurate and current. We will handle all personal information we collect in accordance with our Privacy Policy.

4.3 We may also require you to provide additional information in order for us to meet “Know Your Client” obligations. You must comply with any such request by us.

4.4 You are responsible for keeping your account secure and are responsible for all use and activity carried out under your account. You must not share your account credentials or give access to your account with any third party. We do not authorise anyone to use the Platform on your behalf, and we will not be liable for any loss or damage arising from any kind of unauthorised activity that takes place under your account.

4.5 To register a business with a Shouta Biz Account, you will need to go to https://www.shouta.co/biz-pricing, select a plan and enter in your company details including company name, ABN, address and any other details as may be required, and the full name, work email address and mobile number and any other details as may be required of the person responsible for using the Platform. To log into Shouta Biz, you will need to go to https://biz.shouta.co/login and enter in your email address used to create the Account. You will receive an authorisation number to your email to enter onto the log in page. Note that the authorisation code is valid for two (2) minutes. We may also request additional information from you, and you must reasonably comply with any such request by us.

4.6 You must not impersonate some other individual, business or company. In case you try to present yourself as another individual or company, your account may be suspended, and legal action may be taken against you.

- Uploaded Content

5.1 Where the Platform allows you to upload any Uploaded Content, you:

-

- represent and warrant to us that you have all right, title, interest and authority in the Uploaded Content;

- represent and warrant to us that you have the permission to use the name and likeness of each person whose image appears in any Uploaded Content in the manner contemplated by these Terms;

- represent and warrant to us that the use or exploitation of Uploaded Content will not infringe the rights of any third party (including, but are not limited to, intellectual property rights and privacy rights); and

- agree and undertake to us to pay all amounts which become owing to any person (whether by way of royalty or otherwise) as a result of or in connection with your submission of the Uploaded Content to or via the Platform.

- It is your responsibility to back up any of Uploaded Content to your own systems.

We do not guarantee that the Platform will always be available at all times. - You agree that we can store Uploaded Content in our servers.

- To the maximum extent permitted by law, you release us and indemnify us from any claim or loss in relation to Uploaded Content being stored in our servers.

- Your conduct

6.1 In using the Platform, you must:

-

- always act courteously and politely with us and any other User;

- strictly comply with any policy displayed on the Platform;

- obey all laws whatsoever (including international law), and any company policy or code of conduct or related contract which may apply in respect of your use of the Platform;

- not take any action that is likely to impose upon the Platform (or our servers, or the servers of our or third-party suppliers) a disproportionately large load;

- not interfere with the proper working of the Platform or any activities conducted via the Platform, including by using any automated or manual software or process to "crawl", "spider"; or engage in similar conduct in relation to the Platform;

- except to the extent the Copyright Act allows you to do so, not reverse engineer or otherwise seek to obtain any source code forming part of the Platform;

- not to do anything or add any Uploaded Content or any Uploaded Content belonging to the User of Shouta Biz:

(i) that may result in you, us or any other User breaching any law, regulation, rule, code or other legal obligation;

(ii) that is or could reasonably be considered to be obscene, inappropriate, defamatory, disparaging, indecent, seditious, offensive, pornographic, threatening, abusive, liable to incite racial hatred, discriminatory, profane, in breach of confidence, in breach of privacy or harassing;

(iii) that would bring us or the Platform into disrepute;

(iv) that infringes the rights of any person;

(v) that you know (or ought reasonably to suspect) is false, misleading, untruthful or inaccurate; or

(vi) that contains or constitutes unsolicited or unauthorised advertising (including junk mail or spam).

- General rules applying to shouts

7.1 The Platform allows Users to gift or redeem Shouts.

7.2 We reserve the right to specify limits on the amount of an individual Shout, the total amount of Shouts made by you in a given period of time, and/or the total amount which a Shoutee may hold in their Account at any given time and/or the Total Transaction Value. Such limits and Maximum Values and Minimum Values will be set out on the Platform and are subject to change from time to time at our sole discretion. We may at our sole discretion allow you to exceed such limits provided that you comply with any additional conditions set by us, including without limitation, that you provide us with “Know Your Client” information.

7.3 Shouts can only be sent to Shoutee’s who hold an Australian mobile number.

7.4 While we endeavour process Shouts within 10 minutes of payment, we do not guarantee any processing times for Shouts. It may take time for Shouts to appear on a Shoutee’s Account. We will not be liable for anything in connection with a Shout’s processing times.

7.5. Any Accounts or individual Shouts which are either:

(i) unregistered and unclaimed in the Shouta App expire within 90 days of purchase; or

(ii) registered and claimed but any balance not used within 3 years of their purchase;

will be treated as expired, and we will retain the balance of the Account or relevant Shout.

7.6 Shouts are redeemable via a digital Shouta Mastercard. Once activated, the Shouta Mastercard can be spent online by getting card details from the App or in store by adding the card to a digital wallet. The card can be used at Australian retailers only that accept Mastercard.

7.7 The Shouta Mastercard expires 3 years from the date of activation. Shouta shall, in its absolute discretion, be entitled to claim any balance left on your Account that has not expired, unless you activate a new Shouta Mastecard. To activate a new Shouta Mastercard via our current issuer, EML Payment Solutions Limited ABN 30 131 436 532 AFSL 404131, it will cost you AUD$5.00, however this fee may vary should Shouta elect to use a different provider or issuer at any point in time.

7.8 You irrevocably agree that we are entitled to do all actions that we deem necessary (at our sole discretion) in order to facilitate, oversee or supervise any Shout or Account. You further agree that we may reverse any Shout or terminate any Account at our sole discretion for any reason, including without limitation if we determine that you or any other relevant User are in breach of these Terms & Conditions or any applicable laws, or because of any suspected fraud or error.

- Subscription Services

Subscription Plans

8.1 Shouta Biz offers three Subscription Plans on an unlimited, monthly or annual basis. These include the Basic, Standard and Premium plan (collectively “Subscription Plans”). To access these services, you must have a Shouta Biz account and comply with these Terms.

8.2 You may purchase any one of these Subscription Plans via Shouta Biz www.shouta.co/biz-pricing. The description of what is included in the Subscription Plans are contained on Shouta Biz for your consideration and may change from time to time.

Monthly or Annual Subscription Fee and Online Payment Security

8.3 The monthly or annual subscription fee payable for the Standard and Premium Subscription Plan is based on the price published on Shouta Biz, from time to time, and will be specified on the invoice at the time of purchase. Shouta Biz reserves the right to change the price and the products and services offered with the Subscription Plans at any time. The price, products and services included in your Subscription Plan will be honoured for the subscription period from the date of purchase or upgrade. All payments must be paid in full upon receipt of an invoice.

8.4 Fees for the Subscription Plans:

(a) Basic:

(i) No subscription fee applies for the Basic plan and applies for an unlimited timeframe.

(b) Standard

(i) On a monthly Standard plan, the total cost is AUD $14 (excluding GST) per month;

(ii) On a yearly Standard plan, the total cost is AUD $144 (excluding GST) per annum.

( c) Premium

(i) On a monthly Premium plan, the total cost is AUD $24 (excluding GST) per month;

(ii) On a yearly Premium plan, the total cost is AUD $240 (excluding GST) per annum.

8.5 Your monthly or annual subscription fee for the applicable Subscription Plans can be paid by credit card through Shouta Biz’s secure online payment gateway. You must ensure that your payment details are accurate and kept up to date. You must inform us immediately should your payment details change.

8.6 Your monthly or annual subscription fee can be paid by credit card through our secure online payment gateway. Credit Card details will be retained by the payment gateway used by Shouta Biz to process your subscription payment. Subscription renewal will occur automatically unless you inform Shouta Biz you do not wish to continue. You authorise Shouta Biz to debit your account on the monthly or annual cost of your chosen Subscription Plan for the minimum term.

8.7 If your payment fails for any reason, you will be downgraded to Shouta’s Basic / no cost plan. If you do not update your payment details within 30 days of being notified to do so, you will lose any data you would have been entitled to access on the higher plan.

8.8 We may from time to time, send out by invitation only, discounted Subscription Plan pricing not available on the Platform, for early Users or other parties as determined by Shouta in its absolute discretion. To be eligible to receive such discounted Subscription Plan Pricing, an invited User will need to be confirm their acceptance within an agreed timeframe. All communications regarding such offer(s) and timeframes for acceptance will be confirmed in an invite only email.

Subscription Plan Features

8.9 Cancel and refund shouts back to company balance - If you are subscribed to a Subscription Plan that allows the refund of unclaimed shouts back to a company balance, this must be done within 90 days of the Shout send date. If this has not been done within the 90 day period, Shouta has the right in its absolute discretion to the unclaimed Shout value. Unclaimed shouts can be viewed in the shout history tab on the Platform as "sent" instead of "claimed."

8.10 Company balance funds - This is an alternate method of payment instead of card payments, whereby Users can generate an invoice to preload funds into their company balance to draw down from at checkout. The preloaded funds must be used within 90 days from the top up date or Shouta reserves the right to claim any unused funds from the company balance.

8.11 Changes to subscription plan features - We reserve the right to implement a new feature, remove a feature or modify an existing feature. If we implement a change, we will give you advanced notice such as by posting changes on our Platform or sending you an email.

Cancellation and Refunds

8.12 You may cancel the Subscription Plans at any time. On a monthly Subscription Plan, no refund is available for the month you cancel the plan. Once the monthly plan has been cancelled, no further payments will be made from your account. On an annual Subscription Plan, no refund is available during the year you cancel the plan. Once the annual plan has been cancelled, the plan will not renew for the following year and no further payments will be made from your account.

Upgrade or downgrade of Subscription Plan

8.13 You may upgrade or downgrade your Subscription Plan at any time during the monthly or annual term of the subscription by emailing us at biz@shouta.co. For the avoidance of doubt, the new payment terms will only apply from the following month, or where a yearly Subscription Plan has been purchased, at the commencement of the following year. Where you upgrade partway through a billing cycle, you will be required to pay the additional costs remaining in that month upfront. If you elect to downgrade your Subscription Plan, you will no longer receive all of the features and benefits of your then current Subscription Plan, and any additional data including additional users, will be deleted 30 days after the date you elect to downgrade your Subscription Plan. The Basic Subscription Plan can be upgraded at any time to Standard or Premium.

Termination of Subscription Plan

8.14 You must at all times comply with these Terms when using the Subscription Plans and accessing your account. Shouta Biz reserves the right, in their sole discretion, to suspend or terminate your subscription, including if Shouta Biz believes you have abused the services in any way or have breached these Terms. Where the Subscription Plan is terminated due to a breach of these Terms, the balance of the instalments due for the remainder of the term of the subscription will become immediately due and payable.

- Sending Shouts

9.1 A Shouter must register on the Platform in order to send any Shouts.

9.2 You must use an Australian banking institution in order to gift a Shout.

9.3 Where you act as a Shouter by gifting a Shout through the Platform, you agree that:

-

- you must use our Payment Provider to pay the selected Shout and you agree to all of the Terms & Conditions of the Payment Provider;

- you irrevocably gift the Shout (including all interest and title to it) to the Shoutee effective of the moment you make the relevant payment. The Shout is non-refundable otherwise than in accordance with these Terms & Conditions;

- the Shout will be transferred to the Account of the Shoutee;

- you may not cancel or reverse a Shout without our consent, which is at our sole discretion and on a case by case basis; and

- notification of the Shout will be sent to the Shoutee via SMS or email depending on whether the Shouter is a registered User of Shouta or Shouta Biz. If you enter an incorrect number or email, the Shout may not be received by the Shoutee. You are solely responsible for entering the correct mobile telephone number or email address of the Shoutee and we exclude any liability in relation to any errors or mistakes made by you.

9.4 Shouta may in the future, require the User to create a username and password to access your Account. You will be responsible for maintaining the security of your password for this Platform, and Shouta will not be liable for any loss or damage arising from or in connection with your failure to comply with this security obligation. We will notify you when a password is required. You agree that Shouta will be entitled to assume that any person using this Platform with your username and password is you. You will be required to notify Shouta immediately of any known or suspected unauthorised use of any password or any breach of security.

- Redeeming a Shout

10.1 Shoutees must use the link sent to them to activate their Accounts in order to redeem any Shouts.

10.2 If the Shoutee fails to activate their Account or redeem their Shout, the Shouter has the option to send the Shout to another Shoutee, however the Shouter acknowledges and agrees that the Shout is not refundable.

10.3 The Account operates as a Virtual Prepaid Mastercard debit card. A Shoutee may use the balance of the Account to pay for things as the Shoutee sees fit (like any other virtual Mastercard debit card), irrespective of any intention of the Shouter or the ‘type’ of Shout chosen by the Shouter.

10.4 Where you act as a Shoutee by redeeming Shouts through the Platform, you agree and acknowledge that:

-

- any purchases made by you using the Account will be deducted from the Account;

- any unused balance will remain in the Account as a balance;

- your Account is not a credit facility - if a purchase exceeds the Account balance, you will have to pay the difference with another payment method;

- your Account is a virtual card, and no physical card will be sent to you;

- You may only use the Account for purchases in Australia;

- You cannot “stop payment” on any transaction after it has been completed. If you have a problem with the purchase or a dispute with the merchant, you must deal directly with the merchant;

- all transactions (whether by you or someone else) are your responsibility, subject to these Terms & Conditions.

10.5 If a Shoutee suspects any unauthorised or fraudulent transactions using their accounts, they should contact us immediately and we may try to facilitate a chargeback, at our sole discretion. Please be aware of clause 15.2.

10.6. Shouts are redeemable via a digital Shouta Mastercard. Once activated, the Shouta Mastercard can be spent online by getting card details from the App or in store by adding the card to a digital wallet. The card can be used at Australian retailers only that accept Mastercard.

10.7 The Shouta Mastercard has merchant category code restrictions and transactions will decline if merchant category codes reflect the following merchants:

a. Money Transfer Merchant

b. Manual Cash Disbursement

c. Financial Institutions - merchandise, services and debt repayments

d. Quasi Cash Merchant

e. Government Owned Lottery

f. Government-Licensed On-Line Casinos (On-Line Gambling)

g. Government Licensed Horse/Dog Racing

h. Betting, including lottery tickets, casino gaming chips, off-track betting and wagers at race tracks

i. Payment service provider-Money transfer for a purchase

j. Payment service provider-Member financial institution

k. Payment service provider-Merchant-Payment transaction

l. Money transfer-Member financial institution

10.8. From time to time we may sell limited edition shouts in collaboration with other brands and businesses. The value of these shouts may be locked for redemption at specified retailers, venues or other locations only. We will specify when shouts can only be redeemed at certain places.

- Fees

11.1 This clause 11 applies in relation to Shouters only. Shoutees do not have to pay us any fees.

11.2 We are entitled to charge the Platform Fee each time you send a Shout.

11.3 Platform Fees:

Shouta Biz:

(a) Basic:

(i) The Platform Fee is 7% (excluding GST).

(b) Standard

(ii) The Platform Fee is 7% (excluding GST).

(c ) Premium

(iii) The Platform Fee is 4% (excluding GST).

Shouta App and WebShouts:

(i) The Platform Fee is 7% (excluding GST). We may from time to time in our absolute discretion, run price testing for small cohorts of our Users and a different fee may be shown at checkout.

11.4 The Platform Fee is payable at the time you send a Shout, as an increased amount on top of the total amount of each Shout.

11.5 The Platform Fee is strictly non-refundable unless we determine otherwise, which we may do at our sole discretion and on a case-by-case basis.

11.6 We may charge handling or administration fees for any time spent by our staff or agents, and also including reimbursements for any fees charged by other financial institutions, in instances where we have to attend to your errors or mistakes, or any instances where there are insufficient funds or details are entered incorrectly.

11.7 We reserve the right to implement a new fee, or modify an existing fee (including the Platform Fee) for certain current or future features of the Platform. If we implement a new or modified fee, we will give you advanced notice such as by posting changes on our Platform or sending you an email. You agree to pay those fees and any associated taxes for your continued use of the applicable service. Unless otherwise stated, all fees and all transactions are in Australian Dollars.

11.8 Unless otherwise expressly stated, all amounts payable through your use of this Platform are expressed to be inclusive of GST. For these purposes, the term "GST" has the meaning given to it in the A New Tax System (Goods and Services Tax) Act 1999 (Cth).

- Promotions

12.1 For certain campaigns, promotions or contests, additional Terms & Conditions may apply. If you want to participate in such a campaign, promotion or contest, you need to agree to the relevant Terms & Conditions applicable to that campaign, promotion or contest. In case of any inconsistency between such Terms & Conditions and these Terms & Conditions, those Terms & Conditions will prevail.

12.2 Where any discounts and/or offers are made available by Shouta from time to time, you shall be entitled to use such discounts/offers to purchase your Shout in accordance with these Terms & Conditions or as otherwise directed on our Platform.

12.3 Unless otherwise stated, all Promotions apply to Shouts purchased for Shouta and Shouta Biz. Shouta reserves its rights to implement Promotions for Shouta Biz, which Promotions are not applicable to Shouta and vice versa.

- Intellectual Property Rights

13.1 Except where otherwise indicated or implied by context, we are the sole owners or licensees of all intellectual property comprised in the Platform (including all intellectual property comprised in the Platform content), and nothing in these Terms & Conditions constitutes a transfer of any intellectual property rights in or related to the Platform or Platform content.

13.2 You acknowledge and agree that the Platform and the content contained therein are protected by copyright, trademarks, service marks, patents, design registrations, and other proprietary rights and laws, and you agree to comply with and maintain all copyright notices and other restrictions on content accessed on or via the Platform.

13.3 You must not do anything which breaches or otherwise interferes with our intellectual property rights or the intellectual property rights of any of its third-party licensors. You may not distribute, reproduce, publish, alter, modify or create derivative works from the Platform content without our prior written permission or the relevant third-party licensor or exploit such contents for commercial benefit.

13.4 You acknowledge and agree that damages may not be an adequate remedy for a breach of this clause 13 and that equitable or injunctive relief may be necessary.

13.5 The Shouta Mastercard is issued by EML Payment Solutions Limited ABN 30 131 436 532 AFSL 404131 pursuant to license by Mastercard Asia/Pacific Pte. Ltd. Mastercard and the

Mastercard brand mark are registered trademarks and the circles design and Tap & go are

trademarks of Mastercard International Incorporated. Apple Store, Apple Pay and iPhone are trademarks of Apple Inc., registered in the U.S. and other countries.

- Third party sites

14.1 The Platform may contain links to websites that are owned and operated by third parties. We have no control over these external websites, which are governed by Terms & Conditions and privacy policies independent of us.

14.2 You acknowledge and agree that when you access a third-party website available via a link

contained on the Platform:

- you do so at your own risk and understand that you should review the privacy policy and Terms & Conditions of that website;

- we are not liable for the content, accuracy, lawfulness, appropriateness, or any other aspect of that third-party website; and

- you acknowledge and agree that to the full extent permitted by applicable law, we will not be liable for any loss or damage suffered by you or any other person as a result of or in connection with your access or use of any third-party website available via a link on the Platform.

- Limitation of liability

15.1 To the maximum extent permitted by law, we exclude all Warranties whatsoever unless

expressly stated, including but not limited to in relation to any other User of the Platform

or any goods or services offered by us.

15.2 You acknowledge that when you use the Platform or the Account in any way, you do so

entirely at your own risk and relying on your own enquiries and judgement. All risk of loss

and title in the Shout passes to the Shoutee immediately upon the electronic transmission

to the Shoutee or to us, whichever is earlier. We exclude any liability arising in connection

with you losing access to your Account or any unauthorised access to your Account. You

are solely responsible for maintaining the security of your Account. Likewise, a Shouter is

solely responsible and liable for any activity on their registered account, and the security of

their registered account.

15.3 Any Shout is a gift from a Shouter to a Shoutee and we are not liable or responsible in any

way besides facilitating the transfer of the Shout.

15.4 In the event that any User’s computer system is hacked, Shouta Biz is in no way liable for any theft or loss incurred and will not refund any unauthorised transactions which occurred on the Platform.

15.5 To the extent that any law restricts our right to exclude Warranties under these Terms & Conditions, these Terms & Conditions must be read subject to those provisions and nothing in these Terms & Conditions is intended to alter or restrict the operation of such provisions. If those statutory provisions apply, notwithstanding any other provision of these Terms & Conditions, to the extent that we are entitled to do so, we limit our liability pursuant to such provisions:

(a) in the case of goods:(i) the replacement of the goods or the supply of equivalent goods; (ii) the payment of the cost of replacing the goods or of acquiring equivalent goods; and

(ii) in the case of services:

-

-

-

-

-

-

- the supply of the services again; or

- the payment of the cost of having the services supplied again.

-

-

-

-

-

15.6 Our liability arising in connection with these Terms & Conditions or the Platform is limited as follows: we exclude all liability for consequential, special, indirect or remote loss, including loss of opportunity or business;

-

- our total maximum total liability arising in connection with these Terms & Conditions is capped to the total amount of any Platform Fee relevant to the particular matter;

- our liability is excluded to the extent that you contributed to the liability;

- we exclude all liability for anything you have been aware of for longer than six months and you have not commenced a claim; and

- our liability is subject to your duty to mitigate your loss.

15.7 We provide the Platform on an “as is” and on an “as available” basis without any Warranties as to continuous, uninterrupted or secure access to the Platform, that its servers are free of computer viruses, bugs or other harmful components, that defects will be corrected, or that you will not have a disruption or other difficulties in using the Platform.

15.8 In the event that we terminate the Platform or your access to the Platform pursuant to these Terms & Conditions, you release us from all liability, loss or claims suffered by you as result of or arising out of such termination.

15.9 All subclauses of this clause 15 are cumulative to one another.

16 Copyright claims

16.1 If you believe that our Platform contains any material that infringes upon any copyright that you hold or control, or that users are directed through a link on this Platform to a third party website that you believe is infringing upon any copyright that you hold or control, you may send a notification of such alleged infringement to us in writing. Such notification should identify the works that are allegedly being infringed upon and the allegedly infringing material and give particulars of the alleged infringement.

16.2 In response to such a notification, we will give a written notice of a claim of copyright infringement to the provider of the allegedly infringing material. If the provider of that material does not respond to us in writing denying the alleged infringement within 14 days after receipt of that notice, we will remove or block the allegedly infringing material as soon as is reasonably practicable. If the provider of that material responds to us in writing denying the alleged infringement, we will, as soon as is reasonably practicable, send a copy of that response to the original notifying party. If the original notifying party does not, within a further 14 days, file an action seeking a court order against the provider of the allegedly infringing material, we may restore any removed or blocked material at our discretion. If the original notifying party files such a legal action, we will remove or block the allegedly infringing material pending resolution of that legal action.

- Release and Indemnity

17.1 To the maximum extent permitted by law, you agree to release the Released Parties from all Loss or Claims arising out of or in any way connected with any Relevant Matter. You further waive any and all rights and benefits otherwise conferred by any statutory or non- statutory law of any jurisdiction that would purport to limit the scope of a release or waiver.

17.2 To the maximum extent permitted by law, you agree to indemnify, defend and hold harmless the Released Parties from any Loss or Claims arising out of or in any way connected with any Relevant Matter.

17.3 In this clause:-

- Claim means a claim, action, proceeding or demand made against a person concerned, however it arises and whether it is present or future, fixed or unascertained, actual or contingent.

- Loss means a damage, loss, cost, expense or liability incurred by the person concerned however arising, including without limitation penalties, fines, and interest and including those which are prospective or contingent and those the amount of which for the time being is not ascertained or ascertainable.

- Released Parties means us and our officers, directors, shareholders, agents, employees, consultants, associates, affiliates, subsidiaries, related parties, related body corporates, sponsors, and other third-party partners.

- Relevant Matter means anything in connection with:

- any Shout;

- any damage to person, property, personal injury or death;

- your breach of these Terms & Conditions;

- any matter for which we have purported to disclaim or exclude liability for under these Terms & Conditions;

- your use, misuse, or abuse of the Platform; and

- your breach or failure to observe any applicable law.

- Termination

You acknowledge and agree that:

- we may terminate your access to the Platform at any time without giving any explanation;

- we may terminate these Terms & Conditions or any Booking Agreement immediately by notice to you in writing if you are deemed to breach these Terms & Conditions or associated policies in any way, in our sole discretion; and

termination of these Terms & Conditions, a Booking Agreement or your access to the Platform does not release you from any of your obligations and liabilities that may have arisen or been incurred prior to the date of such termination.

- Refund Policy

-

- Shouta will be notified as soon as a Shout is purchased and every transaction and purchase is duly recorded by Shouta. Shouta has a strict no refund policy and will not reimburse a Shouter or a Shoutee for any Shout for any reason whatsoever, including but not limited to, incorrect or accidental purchases.

- If for any reason there is an error with your Shout purchase, or you believe a Shout has not been sent or received accordingly, you are required to contact Shouta for assistance.

- Once a Shout has been received by a Shoutee, Shouta is no longer liable to the Shouter.

- Shouta will be notified as soon as a Shout is purchased and every transaction and purchase is duly recorded by Shouta. Shouta has a strict no refund policy and will not reimburse a Shouter or a Shoutee for any Shout for any reason whatsoever, including but not limited to, incorrect or accidental purchases.

20. Topping up your Shouta Mastercard

20.1 Shouta Mastercard can be topped up using PayID. View the PayID terms and conditions here

21. General

21.1 You must not assign, sublicense or otherwise deal in any other way with any of your rights under these Terms & Conditions.

21.2 If a provision of these Terms & Conditions is invalid or unenforceable it is to be read down or severed to the extent necessary without affecting the validity or enforceability of the remaining provisions.

21.3 These Terms & Conditions are governed by the laws of New South Wales and each party submits to the exclusive jurisdiction of the courts of New South Wales and all courts of appeal from there.

21.4 Any waiver of any term on these Terms & Conditions by us can only be done in express writing. Any failure on our part to enforce a term does not constitute a waiver and we reserve the right in relation to all breaches unless expressly stated otherwise.

21.5 The contents of these Terms & Conditions constitute the entire agreement between the parties and supersede any prior negotiations, representations, understandings or arrangements made between the parties regarding the subject matter of this agreement, whether orally or in writing.

21.6 Force majeure: To the maximum extent permitted by law, and without limiting any other provision of these Terms & Conditions, Shouta excludes liability for any delay in performing any of its obligations under these Terms & Conditions where such delay is caused by circumstances beyond the reasonable control of Shouta, and Shouta shall be entitled to a reasonable extension of time for the performance of such obligations.19.7

21.7 Interruptions While we will always strive to ensure our Platform we provide are operational, there are times when there could be unexpected temporary interruptions, including by way of example, maintenance, dealing with technical issues, testing, and the addition of updates to reflect changes to the law or regulatory requirements. Shouta, reserves the right, at any time to modify or discontinue, either temporarily or permanently, any functions and features of our Platform, without any liability to you.

21.8 A provision of these Terms & Conditions which can and is intended to operate after its conclusion will remain in full force and effect – including without limitation clauses 5, 13, 15, 16, 17 and all indemnities, disclaimers and releases.

21.9 We reserve the right to change these Terms & Conditions at any time without notice. Any changes to the Terms & Conditions can be viewed at https://www.shouta.co/terms

Last updated: 16 February 2023

Shouta Pays-enabled Digital Reloadable Prepaid Mastercard® Terms and Conditions

These Terms and Conditions apply to the Shouta Digital Reloadable Mastercard® (“the Mastercard”).

The Shouta Mastercard is issued by EML Payment Solutions Limited (ABN 30 131 436 532) AFSL

404131 (EML) pursuant to license by Mastercard International Incorporated. Shouta Pty Ltd ABN 73

640 181 595 (Shouta) has been authorised by EML to distribute the Mastercard. When we refer to

the Pays, we are referring to Apple Pay, Google Pay or Samsung Pay and further, when we refer to a

Device, we are referring to a mobile or wearable device that allows you to store or otherwise add a

Card to the Device. In these card terms and conditions, we, us or our means EML and Shouta; and

you, your or user means the Cardholder.

1. By activating, storing the Mastercard into your Device or using the Mastercard, you affirm you

have read and agree to be bound by these Terms and Conditions.

2. The Mastercard is a Pays-enabled Digital Prepaid Mastercard that can be used for purchasing

goods and services where Mastercard prepaid cards are accepted for electronic transactions

(excluding transactions at ATMs or over the counter at financial institutions).

3. The Mastercard must be activated prior to use and at least one (1) week prior to expiry. To

activate the Mastercard you must follow the activation steps in the Shouta app.

4. The Mastercard is not a credit card and nor is it linked to a deposit account.

5. There is no interest payable to you on the Available Balance on the Mastercard;

6. The Mastercard is reloadable. The Mastercard cannot be used to make transactions that exceed

the available balance. For such a transaction you need to pay the difference by another method

if the merchant agrees.

7. You must use your PIN to complete transactions over ninety-nine ($99) dollars.

8. The Mastercard does not have cash out capability. You may not use the Mastercard to withdraw

cash.

9. The Mastercard is valid until the expiry date shown within your digital wallet and cannot be used

after expiry. At expiry, the remaining available balance may be transferred to a new card at the

request of the Cardholder. By opting for a new card issue, Cardholder will incur a renewal card

fee as provided under the Fees and Charges section below.

10. To check expiry date, go to the Shouta app.

11. The Mastercard cannot be used to obtain or redeem cash and cannot be used for making direct

debit, recurring, or regular instalment payments. Use of the Mastercard may be declined at

some merchants (such as gambling merchants or merchants who choose not to accept the

Mastercard).

12. In the event the available amount on the Mastercard is less than the purchase amount, some

Merchants may not allow Cardholder to combine multiple payment types (such as cash, check or

another payment card) to complete the Transaction.

13. We charge a service fee of 7% on the total of your shout for using Mastercard. For example, if

you shout someone a coffee for $5, we'll add on a service fee of 35c. However, to the extent

permitted by law, some merchants may charge you for using the Mastercard and such fees may

be deducted from the balance of your Mastercard at the time of the transaction.

14. You are responsible for all transactions on the Mastercard. If you notice any error relating to the

Mastercard, you should notify Shouta Customer Support immediately by telephone or email.

15. You are responsible for checking your transaction history, knowing the available balance and

date of expiry for the Mastercard, all of which will be available to you on your Device.

16. Except to the extent required by law, we are not liable for any loss or damage arising out of or in

any way related to the use of the Mastercard, including:

a. if authorisation is declined for any transaction, except where the authorisation has been

declined because of an act or omission on our part;

b. if you have other cards stored on your Device for payment and you inadvertently use the

Mastercard when using your Device as a payment method;

c. for the use, functionality or availability of a Device;

d. the availability of merchants who allow the use of the Device as payment;

e. reduced levels of service caused by the failure of third-party communications and

network providers (except to the extent deemed liable under the ePayments Code); or

f. if your Device security measures are compromised, you allow others access to your

Device or to otherwise circumvent the security measures of your Device.

17. We are not liable in any way if your Mastercard is lost or stolen, or if funds are misappropriated.

If your card is lost or stolen please visit support@shouta.co to contact us for further assistance.

18. Our liability for breach of a condition or warranty implied by law and which cannot be excluded

is limited to either the resupply of the services or the payment of the cost of having the services

supplied again.

19. If you have a problem with a purchase made with the Mastercard, or a dispute with a merchant,

you must deal directly with the merchant involved. If you have a problem with your Mastercard,

please contact Shouta Customer Support on support@shouta.co during business hours or

alternatively you can send an email to support@emlpayments.com.au

20. We may restrict or stop the use of the Mastercard if suspicious activities are noticed.

Card limits

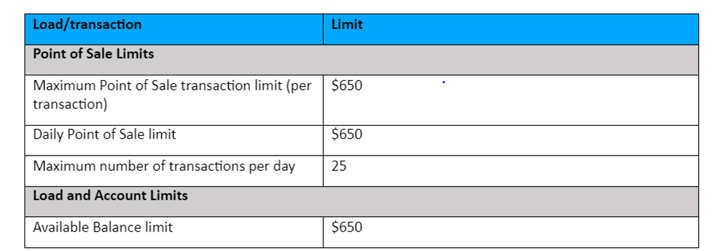

The following table illustrates the transaction and load limits applicable to the Mastercard.

Merchants or other providers of facilities may impose additional limits.

(The Maximum Available Balance is the maximum monetary value that may be loaded at any

given time. The maximum available balance is not to be confused with or reflective of the actual

balance. The actual balance is the monetary value available for use.)

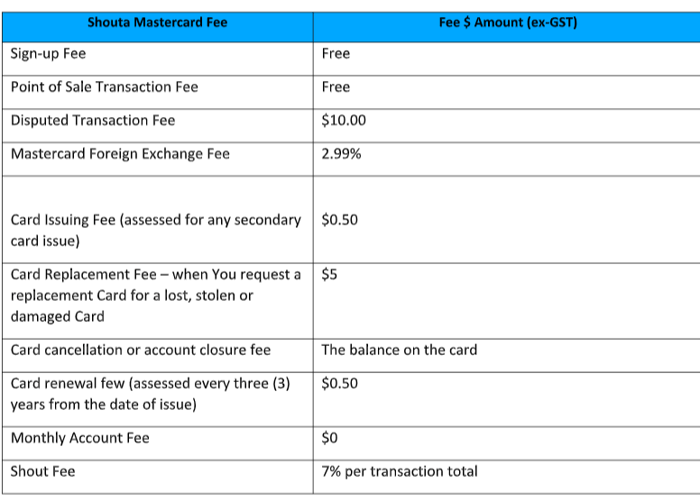

Fees and Charges

All fees will be deducted directly from the available Card balance as set out below.

21. A 2.99% foreign exchange conversion fee applies to transactions in any currency other than

Australian dollars and is calculated on the Australian dollar transaction amount. This will be

included in the total transaction amount debited to the Mastercard.

22. Any refunds on Mastercard transactions are subject to the policy of the specific merchant.

Refunds may be in the form of a credit to the Mastercard, cash refund or in-store credit. If the

Mastercard expires or is revoked before you have spent any funds resulting from a refund

(whether or not the original transaction being refunded was made using the Mastercard) then

you will have no access to those funds.

23. If you have a query about the Mastercard, you should initially contact Shouta by emailing Client

Services on support@shouta.co during business hours. If you have a complaint relating to the

Mastercard, please contact EML at any of the following:

Phone: 1300 739 889 from 8am – 5pm Monday to Friday (Sydney time)

Email: support@emlpayments.com.au

Mail: Locked Bag 5, Fortitude Valley BC, 4006

24. Information will be disclosed to third parties about the Mastercard, or transactions made with

the Mastercard, whenever allowed by law, and also where necessary to operate the Mastercard

and process transactions. A full privacy policy can be viewed

at https://www.emlpayments.com/privacy

25. We reserve the right to change these Terms and Conditions at any time. Any changes to the

Terms and Conditions can be viewed at https://www.emlpayments.com/